Netflix and Cable Prices

Between 2011-2022 Netflix's prices rose 2x faster than cable.

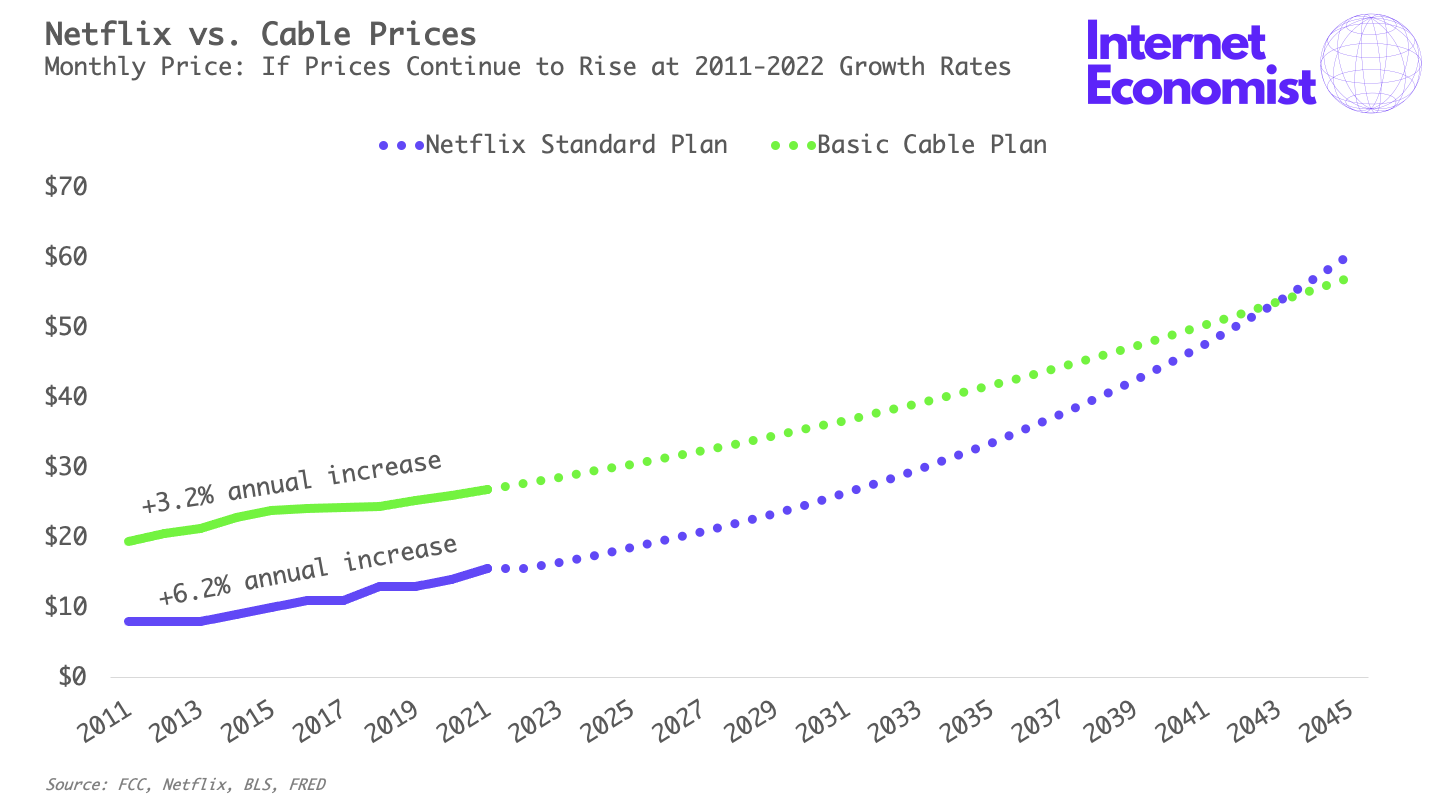

Netflix raised the price of its subscription plans in the US and Canada last week. The company’s standard plan went from $13.99 /month to $15.49 /month in the US, a +10.7% price increase. That same plan in 2011 was priced at $7.99, meaning Netflix has increased prices at an average rate of +6.2% annually over the last 11 years. During the same period, industry prices for cable and satellite television services increased +3.2% annually and US inflation rose +2.0% annually, meaning that in the US, Netflix’s prices have risen approximately 2x faster than cable prices and 3x faster than inflation.

According to the FCC’s most recent report on cable industry prices, the average price of basic cable in the US in 2018 was $25.40 /month – with industry growth rates we’ll assume the current average price is actually closer to $28.68 /month. So even with Netflix’s recent price increase, the company’s standard plan is still only about half the price of a typical basic cable plan and arguably offers more value with no advertising and a lot of original content that doesn't appear on TV.

If Netflix continues raising prices at the same rate that it has been the past several years then it will surpass the current price of basic cable packages by the year 2032. Of course, cable prices will rise as well in an inflationary environment, so if we assume that Netflix continues raising prices at 6.2% annually and cable prices increase by 3.2% annually then the Netflix standard monthly plan will exceed a basic cable plan by the year 2043. Now, obviously firms don't just raise prices infinitely forever, but the point of this exercise is to show how quickly Netflix subscription plans could reach say, $20 /month, or $25 /month.

It’s perfectly normal for companies to raise prices faster than competitors as they transition from being high-growth to mature firms. After all, there are enough competitors in Netflix’s market between cable companies and streaming services, that if consumers are unhappy with Netflix’s prices they can just use a different service. In Netflix’s case, it’s sound financial management to raise prices as the company is still not profitable, but has said it will reach positive cash flow this year.

Economies of scale tells us that unit costs decline as production volume increases. In Netflix’s business that means if the company acquires the rights to a new show for $10 million and the company has 10 million subscribers, then the cost per subscriber is $1. But if the company has 100 million subscribers, that $10 million show now costs just $0.10 per subscriber. In reality, Netflix spent approximately $17 billion on content in 2021 and ended the year with an estimated 222 million subscribers, a cost per subscriber of $76.60 (keep in mind that Netflix has other costs like sales, marketing, facilities, and labor just like any other company). Under the new subscription pricing model, 41% of the annualized price of the standard plan will go towards covering Netflix’s content costs, down from 47% before the price hike.

Netflix has historically spent a lot of money on acquiring content rights while also keeping prices low (relative to the cable industry) to aggressively grow its subscriber base and take share from competitors. That strategy has been successful the past several years, with Netflix growing its subscriber base +149% between 2016-2021 to approximately 222 million subscribers (this is an estimate, as Netflix will report FY 2021 figures on January 20). But Netflix’s quarterly subscriber growth is now slowing in spite of spending more money than ever on content, with one Wall Street analyst predicting 6.25 million net-new subscribers in Q4 2021, representing just 9% year-over-year growth.

It’s no surprise then that as Netflix’s subscriber growth has started to slow that the company would raise prices to improve cash flow while still spending aggressively on content. It’s also likely that Netflix will raises subscription prices again within the next 18-24 months as the company continues its transition from high-growth to being a mature firm.