Crypto Markets and Wash Trading

Suspicious trading activity on NFT marketplace suggests crypto markets still rife with illegal wash trading.

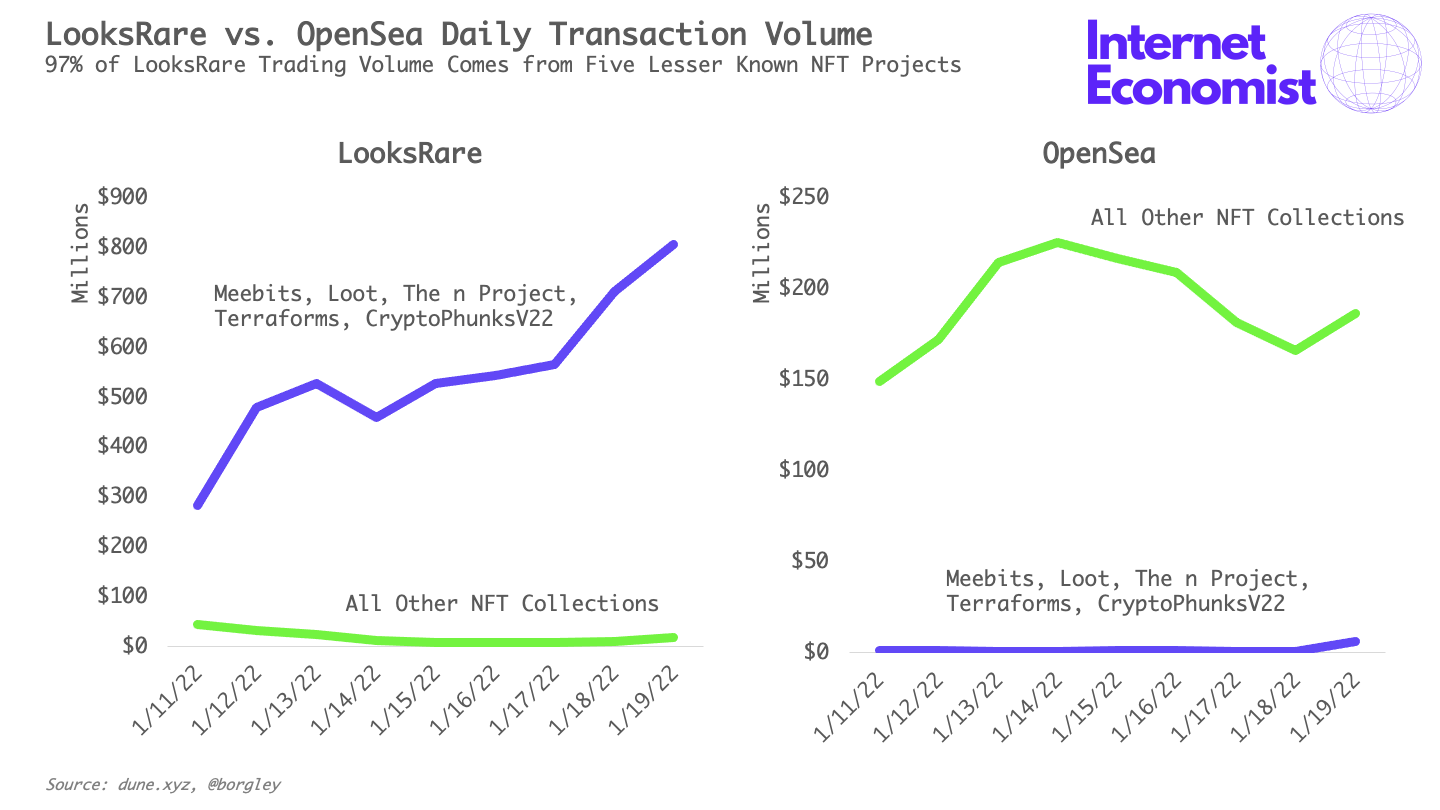

NFT marketplace LooksRare processed over $5 billion across 21,000 transactions in just nine days after launching last week. The trading activity is suspicious because during that period, five lesser known NFT collections (Meebits, Loot, The n Project, Terraforms, and CryptoPhunksV2) accounted for 97% (or, $4.9 billion) of total trading volume on LooksRare but only $12.6 million on the more established OpenSea marketplace.

Wash trading is a form of market manipulation (i.e. it’s illegal) in which an individual or group of people working in concert buy and sell the same asset repeatedly in order to create artificial activity in the marketplace and drive-up prices.

There’s evidence of wash trading across crypto asset classes, not just NFTs. A bombshell study by researchers Lin William Cong, Xi Li, Ke Tang, and Yang Yang found that wash trading accounted for 70% of reported trading volume across 29 cryptocurrency exchanges (including Coinbase and Binance) between July 9, 2019 and November 3, 2019.

Let’s assume the situation has improved since the aforementioned study, and that wash trading (only) accounted for 50% of trading volume across cryptocurrency exchanges in 2021 as more institutional investors have entered the market; that would mean true cryptocurrency transaction volume last year (not including wash trading) was closer to $7-8 trillion, not $14-16 trillion as reported by The Block and Chainanalysis. For context, the foreign exchange market – the largest financial market in the world – has a daily trading volume of $6.6 trillion. Perhaps a better comparison would be the NASDAQ, which has a daily trading volume of $5 billion, or about $1.3 trillion a year.

Even regulators seem to be aware that cryptocurrency exchanges are awash with wash trading. “One way [crypto exchanges] can be inaccurate is an exchange can just outright lie,” SEC Chairman Gary Gensler remarked pointedly in an MIT lecture he presented about cryptocurrencies in 2020. “Another way they can do it is they can be honest about the numbers, but inflate the numbers through something called wash trades.”

There are two reasons why cryptocurrency exchanges (or bad actors operating via exchanges) would want to inflate publicly-reported transaction data using wash trades:

- Artificial liquidity to show there is high volume of market activity

- Artificial price discovery to show there is high demand in a market

Manipulating a market to show the artificial appearance of liquidity and price discovery distorts investors’ confidence (to the upside), attracting more investors and thereby more transaction fees that the exchange can collect. However, when market manipulators decide they no longer want to play the game of artificially propping up a market, liquidity and price will drop to its natural levels which can hurt investors who thought they were participating in a market with fair and transparent information.

The irony of cryptocurrency exchanges either directly or indirectly manipulating cryptocurrency markets is that they are taking on risk that undermines the confidence in their own products and services. Eventually the volatility caused by wash trading and loose regulatory oversight will likely cause divisiveness within the cryptocurrency community between those who are invested in cryptocurrencies as securities vs those who are advocates for cryptocurrencies as a broader utility such as a means of payment.

Until regulators take a firmer stance on banning wash trading from cryptocurrency exchanges, we will continue to see extreme price volatility in NFTs and the broader cryptocurrency market.