Crypto Mining and Energy Subsidies

Governments are inadvertently subsidizing the cost of crypto mining.

Gas, coal, and electricity prices are the highest they’ve been in decades. This is turning into a problem for some countries, especially those that use subsidies to cap energy prices for consumers and businesses. Once a government decides its energy bill is unmanageable it has two options: 1) it can remove the price ceiling on energy prices, pushing more cost onto consumers and businesses, or 2) it can reduce its consumption of fuel.

Yesterday, Kazakhstan’s government decided option #1 was the better alternative and it removed a price ceiling on liquefied petroleum gas (used to power cars). This didn’t go over well with consumers, leading to deadly protests and the capital being set on fire. Eventually, the government resigned, but not before temporarily cutting off the country’s internet which had the second-order effect of bringing down 18% of global bitcoin mining (Kazakhstan is the world’s second-largest producer of bitcoin mining).

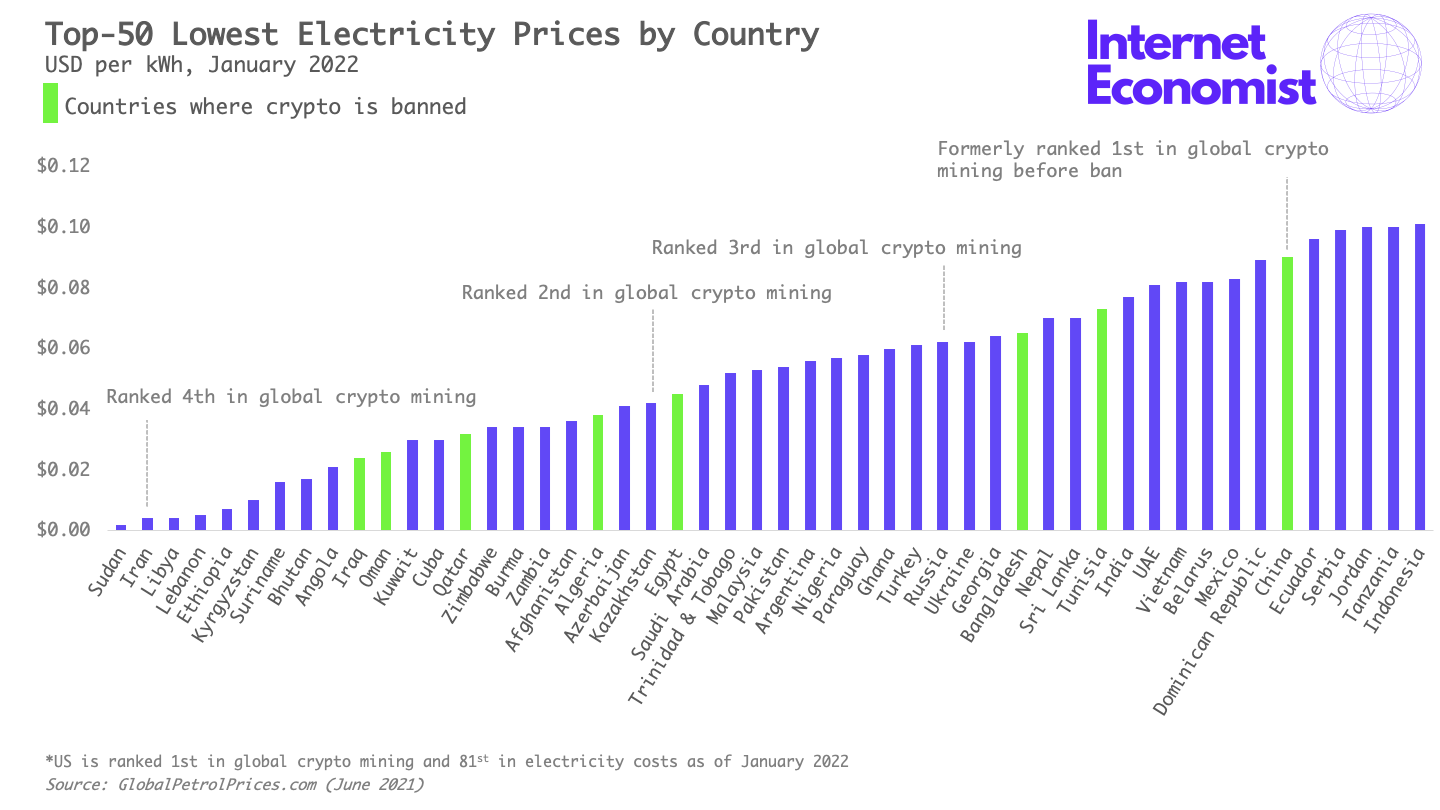

It’s worth noting that Kazakhstan’s aggressive price ceiling on energy prices is what likely attracted cryptocurrency miners to the country in the first place; Kazakhstan ranks #21 in the world for lowest electricity prices. Capping energy prices seems like good policy when it’s used by families to heat their homes in the winter, but bad policy when it’s used to solve esoteric cryptography problems to mine digital gold.

Of the nine countries that have officially banned cryptocurrency, all of them have aggressive electricity subsidies. For example, Qatar, which banned cryptocurrency in May 2021, has a 66% subsidy on electricity, meaning consumers pay just ⅓ of market prices. It’s no surprise that cryptocurrency miners have setup operations where electricity costs are lowest – often as a result of government subsidies. As of January 2022, 65% of the world’s bitcoin mining originates from countries that rank in the top-50 lowest globally for electricity prices.

Rather than tampering with price ceilings, other countries have decided to deal with the energy crisis using option #2: reducing fuel consumption. This has also been bad for the cryptocurrency industry, which most governments probably view as “nonessential” energy consumption. Earlier this week, the Republic of Kosovo announced it was banning cryptocurrency mining to save electricity consumption amid rising energy costs. China enforced a similar ban last year, displacing over 50% of the world’s cryptocurrency mining.

It seems the underlying problem for the crypto industry is that cryptocurrency mining (like many industries) consumes too much energy. If it didn’t consume so much energy then perhaps a) miners wouldn’t abuse energy subsidies, and b) governments wouldn’t bother banning cryptocurrency mining.

For an unregulated industry that provides no official contribution to GDP, a whole lot of energy is being consumed by cryptocurrencies. According to one estimate by the University of Cambridge, bitcoin consumes nearly as much energy per year as gold mining. Gold, of course, is used in all sorts of finished goods like jewelry and electrical components. One could argue that cryptocurrencies are more similar to financial securities (which aren’t recorded in GDP accounts) than gold, but securities are regulated at the federal and state levels whereas cryptocurrencies are not.

Expect the ongoing global energy crisis to lead to further volatility in the cryptocurrency market. Cryptocurrencies will continue to be at the mercy of how countries deal with energy conservation, which could result in more governments banning cryptos in the coming months if they feel the industry is consuming too much energy or abusing energy subsidies.